Boyar Value Group Blog

Read the latest news and insights from the team at Boyar Value Group.

FILTER:

The Boyar Value Group’s 1st Quarter Letter 2024

The Boyar Value Group just released our latest quarterly letter to clients.

Understanding Dividends: How Companies Allocate Money

When Meta recently announced that it will be paying a quarterly dividend (albeit a modest one, at $0.50 per share on a $458 stock), its stock advanced by over 20% that same day,..

The Boyar Value Group’s 4th Quarter Letter 2023

The Boyar Value Group just released our latest quarterly letter to clients.

The Boyar Value Group’s 4th Quarter Letter 2023

The Boyar Value Group just released our latest quarterly letter to clients.

Comcast, Atlanta Braves, and 3 Other Forgotten Value Stocks With Potential to Grow

Boyar Research's flagship report, the 2024 Forgotten Forty, was featured in Barron’s in an interview conducted by senior writer Nicholas Jasinski. The interview discusses the..

Will Small Caps Stand Out In 2024?

Jonathan Boyar joined Yahoo Finance to discuss where he is finding investment opportunities for 2024. He specifically highlights IAC and Madison Square Garden Sports both of which..

Anthony Scaramucci on resiliency, cryptocurrencies, and much more.

Never miss another podcast. Click here to subscribe today to Boyar’s Substack and get all the new podcasts sent straight to your inbox.

Jonathan Boyar on Liberty Braves, Small-Cap Opportunities, and more

Jonathan Boyar joined Yahoo Finance Live to discuss where he sees opportunity in the market today, and areas he would avoid.

A Market of Stocks

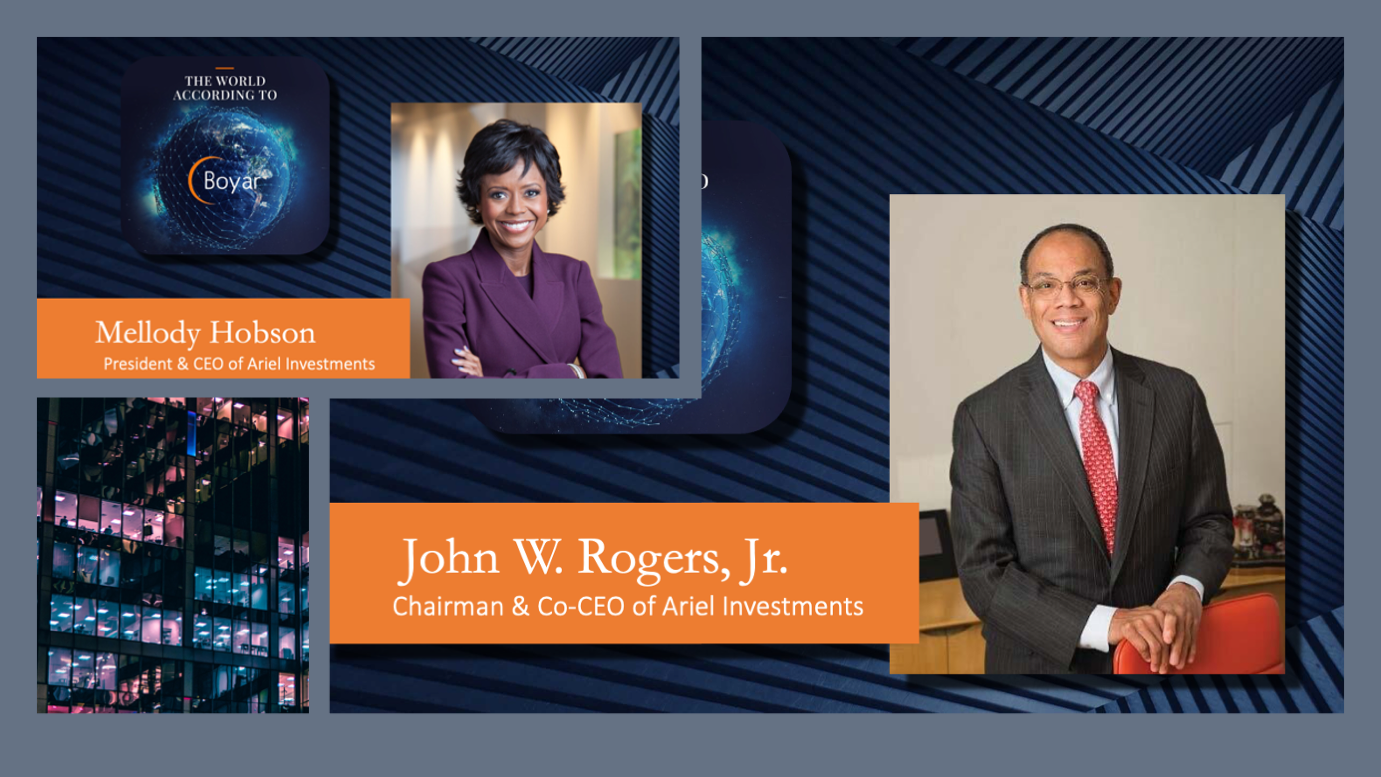

Previous The World According to Boyar podcast guests Mellody Hobson and John Rogers are two of the best investors and businesspeople I know. So when they write something..

Small-Cap Stocks Can Shine in a Recession

“History suggests that leadership of the stock market could soon pass from large-caps to small-caps—especially if an economic slowdown lies ahead. Over the past 11 recessions,..

Guy Spier, Portfolio Manager of the Aquamarine Fund and Author of the Education of a Value Investor

Never miss another podcast. Click here to subscribe today to Boyar’s Substack and get all the new podcasts sent straight to your inbox.

The Boyar Value Group’s 3rd Quarter Letter 2023

The Boyar Value Group just released our latest quarterly letter to clients.